From the position of only teaching Tesla 13 years ago, Toyota now accepts to humble itself before the old 'student' to learn this in the electric car segment.

After 13 years, from being a "student" to learn from Toyota's experiences, Tesla has now changed, when Toyota itself now has to learn from this company to have expertise in producing electric vehicles.

Founded 20 years ago, Tesla's path to becoming a leading electric vehicle maker was paved through a 2010 partnership with Toyota.

The partnership stopped a few years later, but Tesla, which celebrated its 20th anniversary on Saturday, won its first factory from Toyota as well as mass production know-how. . Now, after 13 years, Tesla's position has changed, when Toyota itself now has to learn from this company to have expertise in producing electric vehicles.

"It's finally time for Toyota to learn from Tesla," an executive who oversees production at a Japanese automaker conceded recently. "It was a shock."

"But with the current situation, they will not be able to reduce the price of electric vehicles adequately," the director said. "It's time for Toyota to change production methods."

In this November 2010 photo, Toyota President Akio Toyoda shakes hands with Tesla CEO Elon Musk during a news conference in Tokyo.

From the position of 'teaching' Tesla, Toyota now has to 'relearn'

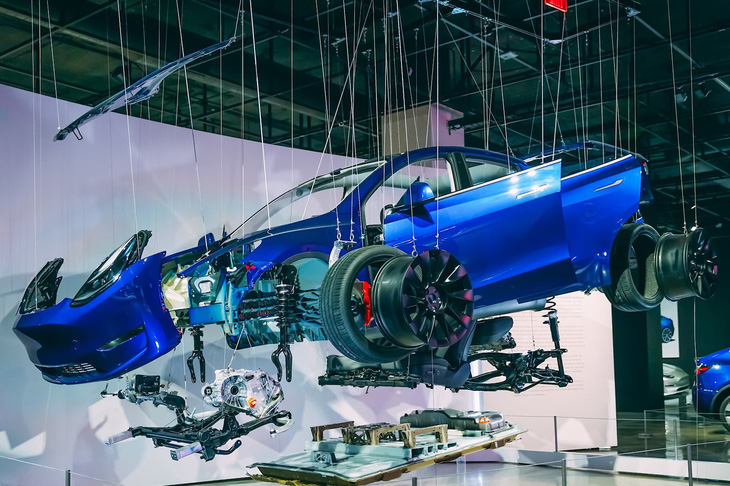

Toyota announced its new gigacasting aluminum die-casting technology in mid-June, with billets of aluminum used to make large modules. Accordingly, the technology could be used for Toyota's next-generation electric vehicles by 2026. Although groundbreaking for the Japanese automaker, Tesla used a similar super-fast aluminum die-casting technology. from earlier.

The bodywork uses conventional manufacturing techniques that require more than 100 sheet metal parts to be welded together. With Tesla's gigacasting technology, which uses a large die-casting machine, the bodywork consists of only two pieces.

The manufacturing technique has been applied to Tesla's Model Y vehicles in 2020 and other products in the lineup, reducing the cost per vehicle by half, on average. Although Chinese electric vehicle startups have followed Tesla's example, Toyota itself is said to be quite reticent with this manufacturing technique.

The reduction in auto parts means fewer orders for suppliers, weakening the pyramid formed by the vertically integrated supply chains of Japanese automakers. . However, Toyota eventually had to change its way of thinking and doing.

"Tesla is the leader in the electric vehicle market. We should learn from them," said a senior Toyota executive. “At the time, no one could have imagined that Tesla would become what it is now,” the executive added, referring to the 2010 partnership. Joining then-Toyota President Akio Toyoda at a news conference in Tokyo in November 2010, Tesla chief executive Elon Musk said he was looking forward to learning Toyota's manufacturing engineering, calling it "the best in the world."

Under the partnership, Tesla received $50 million from Toyota in exchange for about a 3% stake in the company. At the same time, Tesla had to buy part of the recently closed auto plant - from Toyota and General Motors' NUMMI joint venture - in California for $42 million.

Toyota's gift to Tesla 13 years ago

Due to a lack of expertise in manufacturing, Tesla struggled to mass-produce the Model S, the first model to be developed entirely in-house. The company continued to operate at a loss, with cash on hand dwindling to about $100 million.

Meanwhile, the NUMMI factory is fully equipped, helping Tesla not to spend any money on additional purchases. Some factory workers were also retained. One Tesla executive, looking back on the deal, called it a stroke of luck, as the company lacked the know-how to produce prior to the acquisition of the factory.

A Toyota executive has admitted that the Tesla Model Y is a "work of art", after the Japanese automaker dismantled the electric car for research.

In fact, this deal benefits Tesla more than Toyota. The cooperation brings a trickle of profit for Toyota, in addition to helping the Japanese automaker find a buyer for the factory in California.

Sales of electric vehicles have also been weak, leading Toyota to sell its entire stake in Tesla at the end of 2016. According to a Toyota official, Toyoda has taken the lead in forging partnerships with Tesla aims to "stimulate the stagnant development division".

But Toyota engineers, confident they could create an electric vehicle at any time, were not enthusiastic about partnering with Tesla. "With the entry of Tesla and Chinese companies, competitors and rules in the industry are changing," Toyoda said at Toyota's shareholder meeting in June 2017.

Tesla's success has been built on identifying the weak points of the auto industry and going against conventional wisdom.

The company sells its electric vehicles directly online without going through a dealer network. While dealers can offer potential car buyers more personalized service, this results in higher prices and greater costs for the manufacturer.

Tesla also takes a different approach to Toyota's philosophy of continuous improvement, such as always trying to save costs no matter how small. When Tesla builds a new car factory, they reevaluate production methods from scratch each time. The company is constantly looking for ways to reduce costs by 50%, putting pressure on both internally and with competitors.

But Tesla also faced challenges, such as the pitfalls of growing into a large corporation. Employing 120,000 workers, it has the capacity to produce 2 million vehicles per year. It becomes more difficult to make precedent-breaking management decisions that would have been possible at the outset.

The novelty and relevance of the Tesla brand may well be fading. The price of Tesla's used Model 3 in the US has dropped 20% in the half year since this spring, indicating a shift in consumer sentiment. The auto industry is going through drastic changes with the arrival of Chinese automakers and new names from other fields.

Tesla took lessons from Toyota during its ascent, and now other automakers are learning from Tesla. The company that pursued this field as a startup is now being pursued as a leader, facing the challenges and pressures that come with it.

Refer to Asia Nikkei

Operate and exploit advertising by iCOMM Vietnam Media and Technology Joint Stock Company.

Adress: 99 Nguyen Tat Thanh, To 2, Khu 6, Thi tran Tan Phu, Tan Phu, Dong Nai.

Email: phuongtran2191@gmail.com | Tel: (+84) 984654960

Editor in chief: Tran Nha Phuong

Company: Lucie Guillot (Nha Phuong Tran)